With the market talking about the

acceptance of various types of cards, no doubt it has become difficult, but it

will be worth condensing all the card chatter. The question that just does not

sink well soon is that why do we need this sudden shift?

As for India’s case, the Reserve

Bank of India issued a circular in 2015 which entails the statement:

‘Banks are advised that with

effect from September 01, 2015 all new cards issued – debit and credit,

domestic and international – by banks shall be EMV chip and pin-based cards.’

Later the

deadline was extended to September 2016 and banks were informed to replace the magnetic

stripe cards issued, by December 31, 2018.

But what was

the reason? What is so inefficient about the existing magnetic strip cards? The shift from traditional magnetic cards to the

advanced chip & pin cards have given birth to numerous questions in the

minds of business owners and customers.

“EMV chip technology is far more secure than the magnetic

stripe, therefore, EMV has been adopted by many countries.”

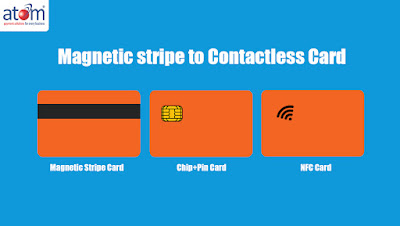

Magnetic stripe cards – The end of an

era?

The history of Magnetic stripe cards dates to the early

1950s. A magnetic stripe card has been named so because the customer’s data is

stored in the magnetic stripe affixed to the back of the card and it can be

retrieved by swiping it through any card swiping device.

The magnetic stripe card contains three tracks and the first

two tracks are encoded with information about the card holder’s account, such

as their credit card number, full name, the card’s expiry date and the country

code while additional information may be stored in the third track.

The flaw is that the information contained in the magnetic

stripe is static.

Hence, it is possible for fraudsters to duplicate the data.

What are chip and pin cards?

Payment cards that comply with the EMV standard (EuroPay,

MasterCard, and Visa – the three companies that originally created the

standard) but stores the data on the integrated circuit or the ‘chip’.

The data retrieved from the chip is unique. Every time a

chip and pin card are used for payment, the chip creates a unique transaction

code which cannot be used again very much unlike Magnetic Stripe cards.

Imagine a hacker stole the chip information from one

specific point of sale. Typical card duplication will not work because the

stolen transaction number created in that instance wouldn’t be usable again and

as a result, the card will be rendered useless as access will be denied.

According to Visa, in March 2017, chip-enabled merchants in

the United States saw a 58 percent drop in counterfeit fraud compared to a year

earlier.

In short, EMV technology will not prevent data breaches from

occurring, but it will make it much harder for criminals to successfully profit

from what they steal. In order to get the credentials, someone would have to

get into the physical chip circuit and manipulate things to get your bank

information.

A new wave – Contactless cards

The shift to chip and pin cards will be a thing of the past

quite soon as the talked about entrant– Contactless card enabled with RFID

technology is even more secure.

Card data is retrieved through Near Field Communication and

Tap and pay, is apparently closing the gaps (not quite literally).

However, a lot of infrastructural issues needs to be

addressed before the shift can actualize. POS Machine need to be able to

accept these technologies in the first place. Given that many of the providers have

completely enabled acceptance of EMV cards, it is certainly a near field

possibility.